Abstract:

Inflation remains a pivotal concern for economists, especially in a developing country such as Pakistan. While moderate inflation is a sign of economic growth, hyper-inflation can undermine consumer confidence and overheat the economy resulting in distorted markets, eroded incomes and such.

This study examines the effectiveness of monetary policy In controlling inflation in Pakistan through a multiple regression analysis-utilising interest rate, exchange rate and unemployment rate (to account for the theoretical relation assumed by the Phillips curve).

The model highlights a multiple R value of 0.84 and a R-squared value of 0.71 suggesting that 71% of the variation canbe attributed to Inflation in Pakistan. The Negative intercept of the unemployment rate also suggests that the Phillipscurve holds true even for a developing country such as Pakistan. These results highlight the complex nature of macroeconomic factors, and underscore the need to further delve deeper into the complexities presented by inflation and monetary in a country such as Pakistan. While the model provides useful insights, it also reinforces the need to further delve into the nuances presented by Monetary policy in context with Pakistan’s economy.

Exploring other variables and policies whilst refining econometric models could help reduce the inaccuracies and strengthen the foundations for policy intervention aimed at achieving Price Stability.

Introduction:

“Monetary policy plays a crucial role in maintaining economic stability by regulating inflation and promoting sustainable growth. In emerging economies like Pakistan, where inflationary pressures have been persistent, understanding the effectiveness of monetary policy tools is vital for both policymakers and the broader economy (Mishkin, 2007; Gali, 2015). In a country such as Pakistan, inflation is a persistent problem that remains unsolvable for the most part; being driven by various factors such as differing oil prices, fiscal problems as well as external burdens. Literature defines monetary policy as a set of actions taken by a central bank typically by manipulating the money supply and interest rates to achieve macroeconomic stability. In Pakistan, inflation has been extremely volatile with the actual rates exceeding the targets set by the state bank of Pakistan (SBP,2022). The state bank of Pakistan has employed various macroeconomic policies designed to curb inflation: adjusting inflation rates, controlling the money supply(M2) through open market operations, but the question still persists: Is monetary policy an effective way to curb and control inflation or is its use only limited to the short run actual growth of an economy?

Central banks, including the state bank of Pakistan, heavily use monetary policy as it associated with a small time lag when compared with short term fiscal and long term supply side policies. Through the alteration of interest rates, central bank aims to influence customer spending by making borrowing expensive and thereby reducing the aggregate demand of an economy. As the country faces both structural and external problems, State bank of Pakistan’s strategy of manipulating this has been a topic of debate especially as Pakistan’s situation is quite unique when compared to the rest of world.

Over the past few decades Pakistan has been experiencing a trend of inflation that has been driven by petrol prices, energy shocks and fiscal deficits. In recent years this inflation driven environment has been turned into a far more complex one as these fluctuating petrol prices external debt and local instability have compounded upon themselves, thus making it far more difficult for policymakers to remedy the situation. This raises the question of monetary policy instrument capabilities in negating the adverse effects of inflation and the chain reaction that it sets off.

One of the key issues of assessing the effectives of such a macroeconomic policy is to understand the relation between interest rates and inflation. It is assumed in theory that when interest rates are set high it automatically discourages inflation, however when looking at it practically and at a national level, it is not as easy as it seems. The variables can vary drastically and well as be more complex when looking at it practically instead of assuming them based on a theory. Moreover external factors such as the volatility of exchange rate can often if not always exert additional pressure on inflation, complicating the transmission mechanism of this policy.

This study seeks to evaluate the effectiveness of the impact of monetary policy on inflation through a detailed analysis with the main focus being on interest rate. However this study also aims to not neglect the effect of exchange rate in this situation, given Pakistan’s vulnerability to currency fluctuations.

The study will use Ordinary Least Square (OLS) regression to test coefficient of the model and determine the extent to which these variables affect the inflation in Pakistan.

By focusing on this topic, this paper aims to contribute to the wide discourse on the role of this monetary mechanism. Findings of this research will offer insights as to whether State bank of Pakistan’s reliance on interest rates has been effective or not. In doing so this may provide valuable context that policymakers may use in navigating through such a problem.

Literature Review:

Monetary policy is an essential instrument used by central banks to influence inflation, economic growth, and unemployment rates. In Pakistan, as in many developing nations, the efficiency of monetary policy has been widely debated. With ongoing increases in inflation and volatile macroeconomic conditions, monetary policy plays an increasingly important role, although its results are frequently influenced by structural constraints and external forces. This literature review critically reviews existing research on the effectiveness of monetary policy in managing inflation in Pakistan.

Overview of Monetary Policy:

Monetary policy refers to the procedure by which central banks control the money supply and interest rates to influence macroeconomic variables such as inflation, unemployment, and economic growth. Mishkin (2007) describes the basic goals of monetary policy as stabilisation of prices, workforce maximisation, and economic expansion. Monetary policy is an economic approach that controls the size and growth rate of an economy’s money supply, making it an important instrument to regulate macroeconomic factors such as inflation and unemployment (CFI, 2022). According to IMF, a country’s monetary policy is intrinsically connected to its exchange rate framework, because interest rates affect the value of its currency so as a result, countries who have fixed exchange rates have less flexibility in monetary policy than countries with flexible exchange rates (IMF, 2023). A completely flexible exchange rate framework enables an effective inflation-targeting strategy.

In Pakistan, the State Bank of Pakistan (SBP), the central bank, is in charge of establishing and implementing monetary policy. Historically, monetary policy has been split into two categories: expansionary and contractionary. Expansionary policy involves expanding the money supply to boost economic growth, which frequently results in increased inflation. In contrast, the contractionary approach seeks to minimise inflation by tightening the money supply, usually by raising interest rates.

A number of scholars agree that stabilizing inflation is critical for promoting long-term economic growth. Taylor (1993) states in his widely recognised work that monetary policy may be exceptionally successful for sustaining stability in prices when central banks employ rules-based procedures, such as the Taylor Rule. According to this concept, central banks should consistently alter interest rates in keeping with inflation and output fluctuations. Taylor’s findings have helped shape modern monetary frameworks, notably Pakistan’s. However, some scholars such as Blinder (2000) contend that such systematic techniques may fail to address the unique issues that emerging countries face. Fiscal inequalities, foreign fluctuations, and political turmoil frequently hinder the efficiency of Pakistan’s monetary policy. This complication makes it difficult to forecast the exact results of monetary initiatives. Khan and Schimmelpfennig (2006) present a detailed study ofPakistan’s monetary system, arguing that while restrictive monetary policies can reduce inflation in the short run, they may have negative consequences for employment and economic development, a compromise that policymakers must carefully evaluate.

Theoretical Framework:

The Phillips Curve, which depicts a negative correlation between unemployment and inflation, presents an empirical basis to comprehend how monetary policy affects inflation. The Phillips Curve suggests that central banks must choose between inflation and unemployment. Iqbal and Zahid (1998) investigated this paradigm in the setting of Pakistan and discovered that, although monetary policy can impact demand-driven inflation, the curve may fail to represent the supply-side dynamics generating inflation in Pakistan. Excessive external debt, inflationary pressures caused by dependency on foreign oil, and fluctuations in food prices are all key factors that make it challenging for the country’s central bank to adequately balance inflation and unemployment. Gregory (2001) contributes to this discussion by proposing that the Phillips Curve’s usefulness fades in the course of time when the economy approaches an optimal level of unemployment at which monetary stimulus has no effect on inflation. However, Kemal (2016) present arguments to counter them, demonstrating that in Pakistan, inflation is frequently driven by cost-push variables like energy costs and agricultural fluctuations, which are less sensitive to traditional monetary policy instruments. They claim that the SBP’s focus on overall inflation rather than basic inflation (excluding commodity and energy prices) can lead to unproductive policy.

A number of studies on monetary policy efficiency use Ordinary Least Squares (OLS) regression as their empirical approach. The study of Ayyoub et al (2011) utilised OLS to examine the influence of interest rate hikes on inflation in Pakistan and discovered a substantial negative association. Their research found that a one-percentage-point rise in interest rates can cut prices by 0.3 to 0.5 percentage points. However, they acknowledged the model’s weaknesses,pointing out that OLS may fail to reflect heterogeneity between inflation and monetary policy. Bhattacharyya (2024) criticize the use of OLS, claiming that vector autoregression (VAR) approaches are more suited for studying such dynamic interactions. The study claims that VAR models allow for more accurate analysis by including feedback loops between inflation and policy adjustments (Bhattacharyya, 2024).

Historical Context of Monetary Policy in Pakistan:

Since its inception in 1948, the State Bank of Pakistan (SBP) has been central to the formulation and implementation of monetary policy. Political turmoil, budgetary shortfalls, and external debt challenges have historically made it difficult for the SBP to keep inflation under control. Zaidi (2006) presents an in-depth examination of Pakistan’s monetary history, highlighting significant reforms such as the introduction of market-driven exchange rates in the 1990s and thetransition to inflation targeting in the early 2000s. Nevertheless, these efforts, inflation management remains difficult, especially during times of external shocks such as the worldwide financial crisis and variations in oil prices. One notable example is the late 1990s hyperinflation period, when the SBP used strong tightening measures to control inflation. The study of Hanif(2014) contends that, while these policies were partially effective, they came at the expense of the growth of the economy. The tightening of monetary policy throughout this period decreased inflation but also caused an overall decrease in GDP growth, prompting concerns about the long-term effectiveness of such approaches in economically developing nations like Pakistan. Following the year 2000, monetary policy techniques shifted, with a stronger emphasis on managing inflation through interest rate fluctuations and open market transactions. However, the study of Agha et al (2005) argues that structural difficulties in the financial industry, such as poor access to finance and unorganised loan markets, weaken monetary policy’s transmission mechanisms. Even if the SBP increases interest rates, the consequences may not be fully felt in Pakistan’s informal economy, which accounts for a considerable portion of total economic activity.

Current Challenges and Effectiveness of Monetary Policy:

In Pakistan, inflation remains an ongoing issue, fueled by both demand-pull and cost-push causes. According to Chaudhry et al (2015) supply-side issues such as shortages of energy and agricultural volatility contribute significantly to inflation in Pakistan, restricting monetary policy’s efficacy. In recent years, the SBP has used more aggressive monetary policy tightening to battle inflation, hiking rates of interest by 150 basis points in 2018 alone. However, Islam (2017) point out that, while these measures have decreased inflation in the short term, they have also resulted in lesser investment and slower economic growth, emphasizing the trade-offs inherent in such policies. Furthermore, Khan and Schimmelpfennig (2006) assert that external variables such as volatility in global oil prices and exchange rate volatility make it challenging for monetary policy alone to control inflation. They argue that in order for monetary interventions to be truly effective, fiscal policy and structural reforms must be implemented in tandem. For example, Pakistan’s massive fiscal deficits, which are fueled by printing money, frequently impede SBP efforts to tighten monetary policy. This viewpoint is reinforced by Siraj (2023) who demonstrate that fiscal deficiencies, rather than monetary policies, are the key drivers of inflation in Pakistan. They argue that without fiscal control, tighter monetary policies could lead to stagflation, which occurs when inflation persists despite poor economic development.

Empirical Studies on Monetary Policy and Inflation:

A number of empirical investigations have looked into the relationship between monetary policy and inflation in Pakistan, with conflicting results. Agha et al. (2005) discovered that monetary policy, specifically interest rate hikes, can successfully cut inflation in the short run. There the OLS method analysis demonstrates that a one-percentage-point rise in the interest rate decreases inflation by up to half a percentage point, supporting the notion that monetary policy is an effective tool for controlling inflation. However, they emphasise that this influence may fade over time, particularly if other macroeconomic factors like as budget shortfalls and external factors are not addressed.

In contrast, Jan (2015) suggest that monetary policy is only successful in managing inflation when fiscal strategies are in synchronisation. Their research demonstrates that during times of budgetary indiscipline, especially when thefederal government borrows excessively from the central bank to cover deficits, tighter monetary policy alone cannot control inflationary concerns. They advocate for better collaboration between the monetary and fiscal authorities to maintain inflation control.

The study of Ahmad (2012) provides a contrasting assessment of the dynamics of inflation in Pakistan and India. They conclude that, while the two countries experience comparable inflationary challenges, Pakistan’s inflation is more resilient to monetary policy due to a poorer financial structure and an absence of regulatory confidence. They argue that inflation targeting, as used in many technologically advanced nations, may be ineffective in Pakistan without additional structural changes such as boosting financial market performance and strengthening central bank authority.

Methodology:

This study is using Ordinary least Squares(OLS) regression to examine and test the relationship between inflation and monetary policy instruments, particularly interest rate and exchange rate in Pakistan. OLS regression was chosen to testhow independent variables and dependent variable correlate. OLS directly estimates this situation. Unlike other complex models such as VAR, OLS provides a straightforward when delving into this relationship thereby making it a more safer option than VAR and SVAR models.

With OLS, the coefficients, obtained from regression, show how much inflation would change when interest rate and exchange rate change by one unit, Ceteris Paribus. This gives a more deeper understanding of monetary policy instruments and its effects. In this study the model seeks to deposit the effect the interest rate and exchange rate into quantifiable values that can be used for further analysis.

Dependent Variable:

Inflation Rate: Measured as the annual percentage change in the consumer price index(CPI). It is the central focus on this analysis.

Independent Variables:

Interest Rate: This average lending rate serves as the most important instrument for monetary policy by influencing borrowing costs, consumer demand and, overall price levels.

Exchange Rate: defined as thevalue of a currency in terms of another. This is included in this study to assess its role in influencing inflation by considering external shocks and oil prices.

Unemployment Rate: percentage of people in the labour force who are currently not working. This is included toassess the Phillips curve model and determine if the hypothetical relation still stands.

OLS Regression Model:

INFLt=β0+β1×INTt+β2×EXRt+ β3×UNEMPt ϵt

WHERE:

INFLt is the inflation rate at time t INTt is the interest rate at time t EXRt is the exchange rate at time t

UNEMPt is the unemployment rate at time t

β0 is the intercept

β1, β2, and β3 are the coefficients that measure the impact of interest rates, exchange rates and unemployment rate on inflation, respectively.

ϵt is the error term, capturing any variation not explained in the model.

Data Collection:

The data was for this study was collected from reputable and verifiable sources, primarily from the world bank data site, covering the period for inflation rate, exchange rate and unemployment rate from 1994-2023 as well as covering the period for interest rate from 2004-2023. Due to previous data for interest rates not being available for before 2004, the rest of the data from 1994-2003 was sourced from trading economics which provided monthly interest rates for Pakistan from the period 1994-2003. The monthly interest rates were added and then divided by the number of months. To further remedy this situation where interest rates changed twice in a single month, the two interest rates were added and then averaged in that single month to provide a true and fair view.

Empirical Analysis:

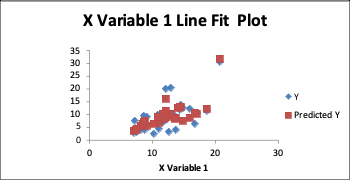

The regression model yields a R-squared Value of 0.71, which indicates a strong positive correlation between inflationand the other statistically significant variables. This statistically significant value suggests that 71% of the variation can be attributed to Inflation in this model.

| Variable | Coefficient | Standard Error | t-Statistic | p-Value |

| Intercept | -7.8906 | 2.5478 | -3.0971 | 0.0046 |

| X Variable 1 | 0.8794 | 0.1983 | 4.4357 | 0.0001 |

| X Variable 2 | 0.1072 | 0.0248 | 4.3268 | 0.0002 |

| X Variable 3 | -1.5922 | 0.6873 | -2.3166 | 0.0287 |

The intercept of -7.89 is statistically insignificant at the 1% level, indicating that in the absence of the variables Inflation would be negative. However as Ahmad(2012) has stated that due to being Pakistan’s inflation being significantly more resilient to monetary Policy, Such expenditure reducing policy would have little to no effect. Furthermore, this study also underscores the underlying effects that effect a developing country such as Pakistan.

Similarly a negative value of X variable 3(unemployment rate) proves true the theoretical relationship presented by the Phillips curve. This theoretical relation although proved to be true in developed countries was lacking a clear explanation and finding about whether such a relation could prove itself to be true in such a relation.

Policy Implications from these results suggest that policymakers should further study inflation and underscore theunderlying factors which affect the effectiveness of monetary policy itself in a developing country in Pakistan.

In conclusion, it can be viable to say that this analysis provides valuable insights into the determinants of Inflation in Pakistan. As Blinder(2000) has suggested such work in a country ignores other implications that affect inflation as a whole. Therefore, further studies incorporating additional macroeconomic variables andeconometric models shall enhance the robustness of the findings.

References :

Agha, A., Ahmed, N., & Mubarik, Y. (2005). Transmission Mechanism of Monetary Policy in Pakistan. SBP Research Bulletin, 1, 1–23. https://ideas.repec.org/a/sbp/journl/01.html

Ahmad, A. (2012). A Critical Appraisal of India and Pakistan’s Monetary Policy. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2137493

Ayyoub, M., Chaudhry, I., & Farooq, F. (2011). (PDF) Does Inflation Affect Economic Growth? The case of Pakistan. ResearchGate. https://www.researchgate.net/publication/263729192_Does_Inflation_Affect_Economic_Growth_The_case_of_Pakistan

Bhattacharyya, R. (2024, August 21). Vector Autoregression. Wallstreetmojo.com; WallStreetMojo. https://www.wallstreetmojo.com/vector-autoregression/

Blinder, A. S. (2000). Central-Bank Credibility: Why Do We Care? How Do We Build It?

American Economic Review, 90(5), 1421–1431. https://doi.org/10.1257/aer.90.5.1421

CFI . (2022, November 24). Monetary Policy. Corporate Finance Institute. https://corporatefinanceinstitute.com/resources/economics/monetary-policy/

Chaudhry, I. S., Ismail, R., Farooq, F., & Murtaza, G. (2015). Monetary Policy and Its Inflationary Pressure in Pakistan.Pakistan Economic and Social Review, 53(2), 251–268. https://www.jstor.org/stable/26153259

Gregory, M. N. (2001). The Inexorable and Mysterious Tradeoff between Inflation and Unemployment. Economic Journal, 111(471), 45–61. https://ideas.repec.org/a/ecj/econjl/v111y2001i471pc45-61.html

Hanif, M. N. (2014, December 22). Monetary Policy Experience of Pakistan. MPRA Paper; University Library of Munich, Germany. https://ideas.repec.org/p/pra/mprapa/60855.html

Iimi, A. (2004). Banking sector reforms in Pakistan: economies of scale and scope, and cost complementarities. Journal of Asian Economics, 15(3), 507–528. https://doi.org/10.1016/j.asieco.2004.03.004

IMF. (2001, September). Bank Reform and Bank Efficiency in Pakistan. IMF. https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Bank-Reform-and-Bank- Efficiency-in-Pakistan-15339

IMF. (2023, January). Monetary Policy and Central Banking. International Monetary Fund. https://www.imf.org/en/About/Factsheets/Sheets/2023/monetary-policy-and-central-banking

Iqbal, Z., & Zahid, G. M. (1998). Macroeconomic Determinants of Economic Growth in Pakistan. The Pakistan Development Review, 37(2), 125–148. https://www.jstor.org/stable/41260096

Islam, S. (2017). Does the monetary policy have any short-run and long-run effect on economic growth? A developing and a developed country perspective | Asian Journal of Economics and Banking. Hub.edu.vn.https://ajeb.hub.edu.vn/en/article/does-the-monetary- policy-have-any-short-run-and-long-run-effect-on-economic-growth-a-developing-and-a- developed-country-perspective

Jan, A. (2015, May 7). Monetary Policy in Pakistan: Effectiveness in Inflation Control and Stabilization. https://www.researchgate.net/publication/281092542_Monetary_Policy_in_Pakistan_Effectiveness_in_Inflation_Control_and_Stabilization

Kemal, A. (2016, December). Inflation in Pakistan: Money or Oil Prices. Working Papers; eSocialSciences. https://ideas.repec.org/p/ess/wpaper/id11507.html

Khan, M. S., & Schimmelpfennig, A. (2006, March 1). Inflation in Pakistan: Money or Wheat? Papers.ssrn.com. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=898721

Mishkin, F. S., Matthews, K., & Giuliodori, M. (2017). The economics of money, banking and financial markets: european edition. https://www.semanticscholar.org/paper/The- economics-of-money%2C-banking-and-financial-Mishkin- Matthews/1ea6483b10fa3d48ab9d8b1d4e93ec9e336ff515

Siraj, S. (2023, September 5). Reason of Inflation in Pakistan. Social Science Research Network. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4561664

Taylor, J. B. (1993). Discretion versus policy rules in practice. Carnegie-Rochester Conference Series on Public Policy, 39(1), 195–214. https://doi.org/10.1016/0167- 2231(93)90009-l

Zaidi, A. (2015). Issues in Pakistan’s Economy: A Political Economy Perspective. In ideas.repec.org. Oxford University Press. https://ideas.repec.org/b/oxp/obooks/9780199401833.html

Zaidi, I. M. (2006). Exchange Rate Flexibility and the Monetary Policy Framework in Pakistan. SBP ResearchBulletin, 2, 115–140. https://ideas.repec.org/a/sbp/journl/08.html