Wealth inequality is described as the “distribution of wealth across households or individuals at a moment in time” (International Monetary Fund, 2022). However, in recent times, the neglect of this metric in economic and social policy—as predicted by Garry Stevenson, Citibank’s most profitable trader in 2011 (Ellingham, 2024), following the Conservative government’s Coronavirus Job Retention Scheme during the national lockdown on the 20th March 2020—has inevitably led to rampant inflation, a sharp rise in asset and stock prices, and a subsequent decline in the standard of living, ultimately resulting in economic austerity (Stevenson, 2020). This is often blamed on events such as Brexit, COVID-19, the Russian invasion of Ukraine, and previous governments in office.

How COVID-19 QE Enriched the Wealthy and Widened the Asset Gap

The MPC expanded its QE program, which had been used in previous years (2009, 2011, 2012, and 2016), by an additional £450 billion in 2020 and 2021, bringing the total value of its assets to a peak of £895 billion (Harari, 2024). Theoretically, if this £ 450 billion monetary stimulus were redistributed equally, each of the 31.7 million taxpayers (HM Revenue & Customs, 2023) would have received approximately £14,000, but this was not the case. Stevenson suggests that during COVID-19, nonessential luxury spending significantly decreased, and the lower, working, and middle classes used furlough relief primarily for essential purchases such as mortgage/rent payments, energy, utility bills, and food. Additionally, individuals and families with greater asset holdings accumulated the most passive income during this period, as their purchasing also drastically decreased due to quarantine measures.

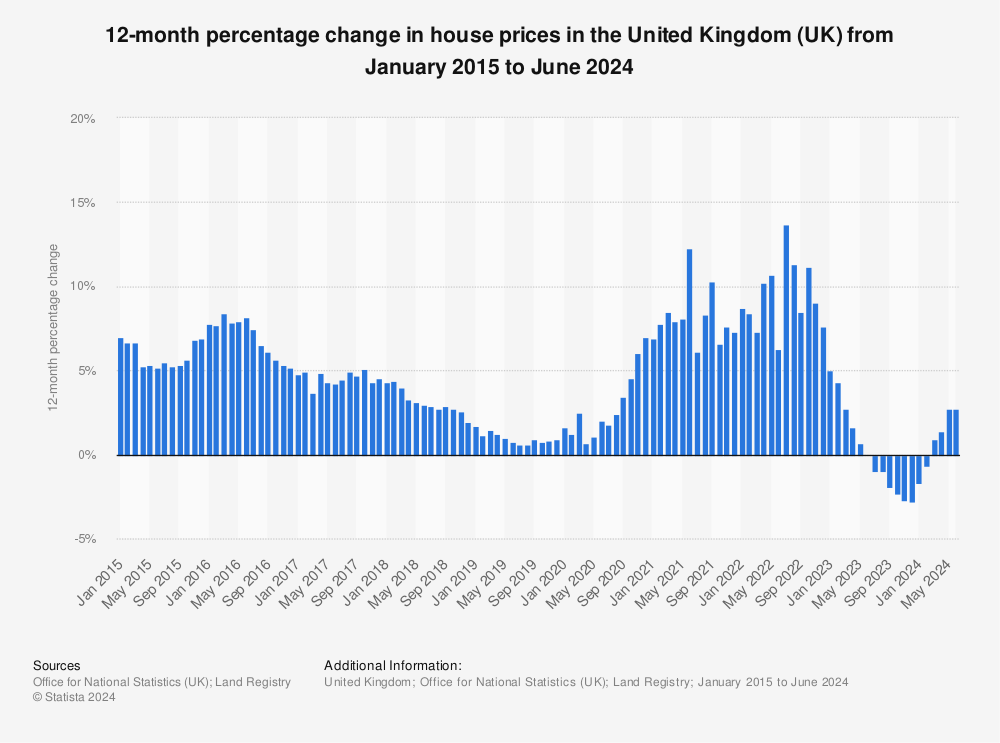

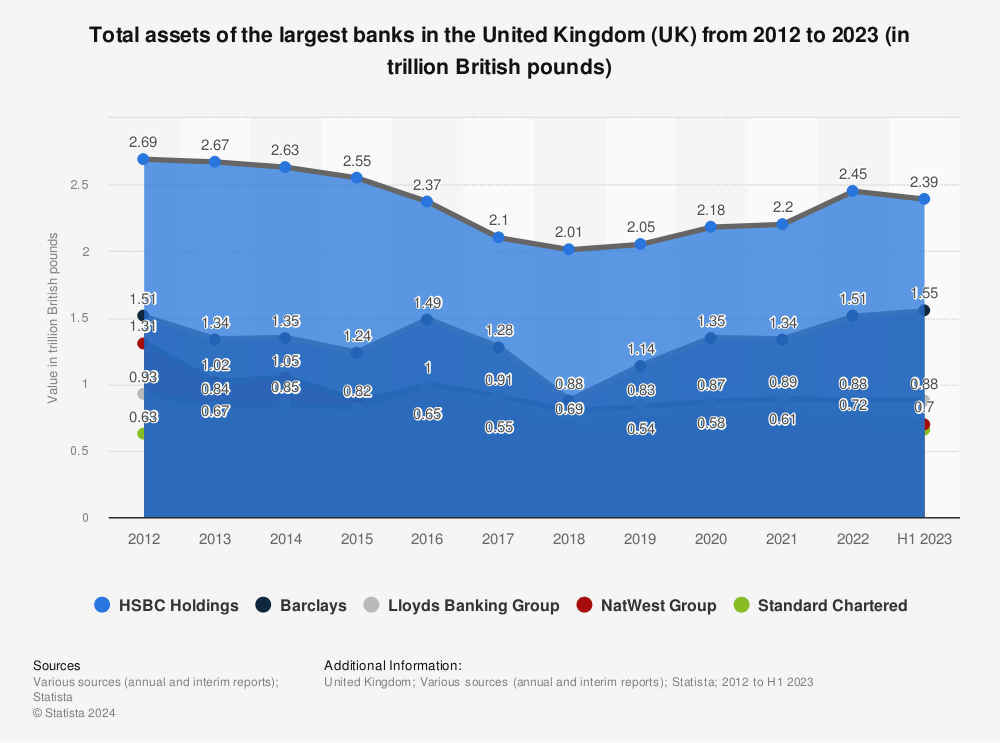

Ultimately, Stevenson argues that this direct transfer of close to £1 trillion from the central bank to the government and then to ordinary working-class families benefitted the wealthiest asset holders in the economy. These individuals contributed to the rising prices of assets, stocks, energy, and other commodities. Figure 1 shows that peak house prices increased annually by 13.7% in July 2022 (Land Registry, 2024), leading to a drastic decline in the standard of living and preventing younger individuals from purchasing their first property, ultimately benefiting the nation’s richest. Additionally, the distribution and availability of assets have become more unequal, as shown in Figure 2, which illustrates that HSBC Holdings, Barclays, Lloyds Banking Group, NatWest Group, and Standard Chartered all had significantly higher asset holdings in H1 2023 compared to any point before the quantitative easing measures implemented in 2020 (Statista, 2024). This means that the largest global corporations now possess more assets, meaning that ordinary working-class families have less access to energy, food, healthcare, and housing.

Figure 1: 12-month percentage change in house prices in the United Kingdom (UK) from January 2015 to June 2024 (Land Registry, 2024)

Figure 2: Total assets of the largest banks in the United Kingdom (UK) from 2012 to 2023 (in trillion British pounds). (Statista, 2024)

Consequences and Problems

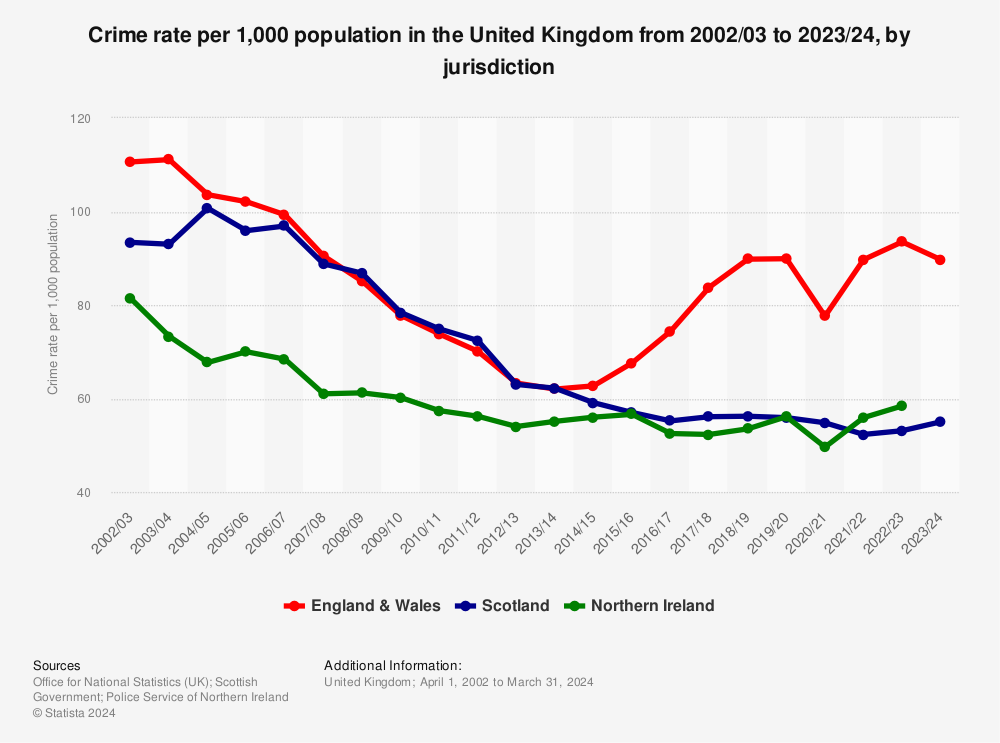

Had the Coronavirus Job Retention Scheme not been introduced, a large majority of UK households would’ve had to endure incredibly difficult conditions, having to go hungry and cold, potentially leading to permanent long-term health implications. Such government intervention was required to prevent a shortfall catastrophe, but the MPC needed to conduct a detailed analysis when £450 billion was printed electronically. If not, we risk eradicating the middle class and building a plutocracy where decisions and policies are influenced by the self-interests of the rich, leading to greater wealth concentration and inequality as the wealthiest individuals buy up assets meant for the young, working, and middle class. This further exacerbates inequality by limiting opportunities for upward mobility and asset ownership for the majority. There will be increased crime since parents of families and households will be unable to provide necessities like food and housing to a satisfactory standard. A developed economy such as the UK has recently seen higher crime in England & Wales, as seen in Figure 3, with an increase from 77.6 to 89.7 from 2020/21 to 2023/24, in the long term potentially mirroring a lower economically developed economy like Mexico, with expanding drug-related crimes from cartels leading to a breakdown of social construct and families fleeing their homes leading to internal displacement. Hence, today, you see a higher emphasis from former US President Donald Trump on his 2024 immigration policy with the proposed increased mass deportations, military involvement, ending birthright citizenship, etc. (Hogan, 2024).

Figure 3: Crime rate per 1,000 population in the United Kingdom from 2002/03 to 2023/24, by jurisdiction (Office for National Statistics (UK), & Scottish Government, & Police Service of Northern Ireland, 2024).

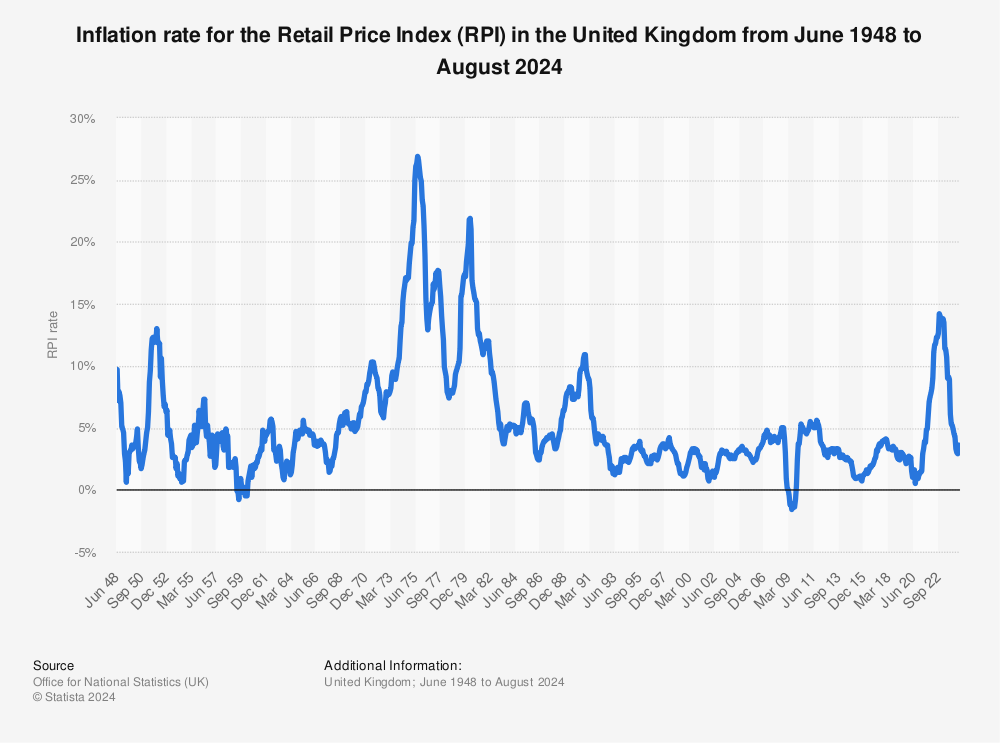

As millionaire and billionaire wealth rises both nationally and internationally, the highest-income earners begin to pay a much lower relative tax rate than working- and middle-class individuals. In Capital in the Twenty-First Century, Piketty (2014) explores this growing concentration of wealth, demonstrating that as wealth accumulates faster at the top, insufficient taxation exacerbates income inequality and leads to declining public resources and tax revenues relative to the wealth amassed by the rich. Consequently, lower tax revenues hinder the government’s ability to fund essential subsidisation programs and impose maximum price caps on necessities like food and energy. Without these protections, rising inflation—reflected by the Retail Price Index (RPI) peaking at 14% in November 2022, as seen in Figure 4—further increases the cost of living, making it particularly difficult for ordinary people to afford basic expenses or to retire comfortably.

Figure 4: Inflation rate for the Retail Price Index (RPI) in the United Kingdom from June 1948 to August 2024. (Office for National Statistics (UK), 2024)

Proposed Solution

This problem ought to be resolved with the introduction of a wealth tax. Many inherently reject the idea of a wealth tax since it directly brings an association of socialism and even, in extreme cases, a communist regime. Over time, major asset holders in the economy significantly influence the purchasing decisions and outcomes of ordinary households, particularly in areas such as home buying and energy consumption. This hierarchy prevents the development of a successful meritocracy. Regardless of whether it is the Labour Party, Conservative Party, Liberal Democrats, or Reform Party, the core issue remains inequality, which is often overlooked by UK politicians who tend to come from higher socioeconomic backgrounds (Savage, 2022). This lack of understanding hampers efforts to address the problem effectively. Notably, the Green Party is the only political group that has committed to implementing a wealth tax as outlined in its 2024 manifesto (Corry, 2024), proposing a rate of 1% on assets valued above £10 million and 2% on those exceeding £1 billion.

A common objection to wealth taxation is the fear that billionaires with UK-based assets will leave the country and relocate to tax havens like the United Arab Emirates, where there is no direct tax. However, UK-based assets, such as property and businesses, cannot simply be moved abroad. For instance, following Russia’s invasion of Ukraine on 24th February 2022, Russian oligarchs like Roman Abramovich, the former owner of Chelsea Football Club (Foreign, Commonwealth & Development Office et al., 2022), and Alisher Usmanov, a major shareholder in mining and telecommunications with past ties to Arsenal Football Club, faced sanctions that directly impacted their wealth (Foreign, Commonwealth & Development Office & Truss, 2022). These sanctions included freezing assets and shares in international firms, severely limiting their ability to generate income from business operations (Foreign, Commonwealth & Development Office & Cleverly, 2023). This caused significant financial losses, functioning similarly to a heavy tax on their business activities.

Wealth taxation is crucial because such oligarchs primarily accumulate wealth passively through their assets, unlike regular employees who earn income through labour. As a result, they pay far less in taxes relative to the capital they generate. Traditional income tax frameworks fail to address this disparity, allowing the wealthy to enjoy low tax rates on passive earnings. Thus, taxing wealth directly becomes necessary to prevent a dystopian society with uncontrollable levels of crime and immigration.

Conclusion

Despite its profound impact on society, wealth inequality remains one of the most overlooked macroeconomic indicators. It is mentioned briefly during educational discussions, such as in A-level economics with the Gini coefficient, but is often neglected in broader policy debates. This lack of attention has allowed wealth inequality to quietly grow into a major threat, with consequences such as falling living standards, rising crime, reduced productivity, and the looming danger of recession or depression. These outcomes inevitably lead to government bailouts, deepening inequality and increasing national debt.

To mitigate this, income must be redistributed either through direct financial support or through the mass subsidisation of goods (via the fiscal dividends of the proposed wealth tax) and services to make essentials more affordable. Without such interventions, the cycle of inequality will persist, worsening economic conditions for the majority. The need to spread awareness about this issue is critical, especially since mainstream media, universities, and government bodies consistently misjudge its severity. With its inherent drive to remain accurate in economic forecasting, the private sector offers a more reliable perspective on the real consequences of wealth concentration.

References:

- Corry, P. (2024, June 11). Greens pledge “Investment to mend broken Britain.” Green Party. https://greenparty.org.uk/2024/06/12/greens-pledge-investment-to-mend-broken-britain/

- Ellingham, M. (2024, March). He made millions betting against economic recovery. Now he wants to fix things. @FinancialTimes; Financial Times. https://on.ft.com/4h4kvYf

- Foreign, Commonwealth & Development Office , & Truss, E. (2022, March 3). Government announces sanctions against Russian oligarchs Alisher Usmanov and Igor Shuvalov. GOV.UK. https://www.gov.uk/government/news/government-announces-sanctions-against-russian-oligarchs-alisher-usmanov-and-igor-shuvalov

- Foreign, Commonwealth & Development Office, & Cleverly, J. (2023, April 12). UK sanctions Abramovich and Usmanov’s financial fixers in crackdown on oligarch enablers. GOV.UK. https://www.gov.uk/government/news/uk-sanctions-abramovich-and-usmanovs-financial-fixers-in-crackdown-on-oligarch-enablers

- Foreign, Commonwealth & Development Office, Prime Minister’s Office, 10 Downing Street, Truss, E., & Johnson, B. (2022, March 10). Abramovich and Deripaska among 7 oligarchs targeted in estimated £15 billion sanction hit. GOV.UK. https://www.gov.uk/government/news/abramovich-and-deripaska-among-seven-oligarchs-targeted-in-estimated-15bn-sanction-hit

- Garys Economics. (2020, July 14). How COVID-19 MAKES the Rich Richer – Gary EXPLAINS the theory [Video]. YouTube. https://www.youtube.com/watch?v=EiblHqbpXHs

- Harari, D. (2024). Interest Rates and Monetary Policy: Key Economic Indicators. Commonslibrary.parliament.uk, 02802. https://commonslibrary.parliament.uk/research-briefings/sn02802/

- HM Revenue & Customs. (2023, June 29). Bulletin – Commentary. GOV.UK. https://www.gov.uk/government/statistics/income-tax-liabilities-statistics-tax-year-2020-to-2021-to-tax-year-2023-to-2024/bulletin-commentary

- Hogan, M. (2024, September 9). Trump vs. Harris on immigration: Future policy proposals. Peterson Institute for International Economics. https://www.piie.com/blogs/realtime-economics/2024/trump-vs-harris-immigration-future-policy-proposals

- International Monetary Fund. (2022). Introduction to inequality. International Monetary Fund. https://www.imf.org/en/Topics/Inequality/introduction-to-inequality

- Land Registry. (August 14, 2024). 12-month percentage change in house prices in the United Kingdom (UK) from January 2015 to June 2024 [Graph]. In Statista. Retrieved September 21, 2024, from https://www-statista-com.uoelibrary.idm.oclc.org/statistics/751619/house-price-change-uk/

- Office for National Statistics (UK), & Scottish Government, & Police Service of Northern Ireland. (July 24, 2024). Crime rate per 1,000 population in the United Kingdom from 2002/03 to 2023/24, by jurisdiction [Graph]. In Statista. Retrieved September 22, 2024, from https://www-statista-com.uoelibrary.idm.oclc.org/statistics/1030625/crime-rate-uk/

- Office for National Statistics (UK). (September 18, 2024). Inflation rate for the Retail Price Index (RPI) in the United Kingdom from June 1948 to August 2024 [Graph]. In Statista. Retrieved September 22, 2024, from https://www-statista-com.uoelibrary.idm.oclc.org/statistics/285203/percentage-change-of-the-retail-price-index-rpi-in-the-uk/

- Piketty, T. (2014). Capital in the Twenty-First Century. Cambridge, MA and London, England: Harvard University Press. https://doi.org/10.4159/9780674369542

- Savage, M. (2022, July 23). Just one in 100 Tory MPs came from a working-class job, new study shows. The Guardian. https://www.theguardian.com/politics/2022/jul/24/just-one-in-100-tory-mps-came-from-a-working-class-job-new-study-shows

- Statista. (January 18, 2024). Total assets of the largest banks in the United Kingdom (UK) from 2012 to 2023 (in trillion British pounds) [Graph]. In Statista. Retrieved September 21, 2024, from https://www-statista-com.uoelibrary.idm.oclc.org/statistics/300792/uk-banking-sector-leading-banks-by-total-assets/

- Stevenson, G. (2020, May 7). I made millions out of the last debt crisis. Now the wealthy stand to win again. The Guardian; The Guardian. https://www.theguardian.com/commentisfree/2020/may/07/i-made-millions-last-debt-crisis-rich-win-coronavirus-fair-tax

| Figure Number | Title |

| 1 | 12-month percentage change in house prices in the United Kingdom (UK) from January 2015 to June 2024 (Land Registry, 2024) |

| 2 | Total assets of the largest banks in the United Kingdom (UK) from 2012 to 2023 (in trillion British pounds). (Statista, 2024) |

| 3 | Crime rate per 1,000 population in the United Kingdom from 2002/03 to 2023/24, by jurisdiction (Office for National Statistics (UK), & Scottish Government, & Police Service of Northern Ireland, 2024). |

| 4 | Inflation rate for the Retail Price Index (RPI) in the United Kingdom from June 1948 to August 2024. (Office for National Statistics (UK), 2024) |