Temu, an online marketplace, offers heavily discounted generic products by shipping directly from Chinese factories, cutting out the ‘middleman’ and using a variety of marketing strategies. Marketing strategies such as free items to users who promote their new ‘hauls’, interactive games, and rewards for inviting friends are an innovative way Temu gets free advertisement, targeting lower income individuals and has led to being the most downloaded app.

Why Temu has spread like wildfire across the UK and US

Amid a cost-of-living crisis, households are looking for ways to save money. From cheap holiday shopping to kitchen accessories, Temu offers an extensive range of products at attractive prices. This need for saving money, combined with Temu’s focus on offering value and a vast array of choices to low-income households, has driven UK demand to new highs.

Similarly, in the US, high inflation has led many households to turn to Temu to get their essential items instead of a more trusted marketplace, Amazon. With immense marketing, awareness has risen to 74% across America showing themselves as a serious competitor in the highly competitive industry and resulted in 40% of Americans purchasing something from the site in the past 6 months presenting the competitiveness this company holds even though they’ve only been in the US market since July 2022.

Problems with their aggressive low-price strategy

Temu’s aggressive low-price strategy has led to challenges, particularly concerning its reputation. Reviews are vital for new companies to convince customers they are a reliable, good quality, and trustworthy website. However, Better Business Bureau has a BBB rating of 1.4 stars due to undelivered packages, random charges and much more resulting in an unsustainable and discouraging customers. Poor reviews leave a lasting stain on their reputation.

This aggressive low-price strategy raises the question whether Temu is making profit. Rob Mckenzie from Heur states insiders at Temu have said they’re losing $30 on each US order. Part of the loss comes in shipping expenses where Temu is said to take a burden of $10 per small package coming into the US.

China Merchants Securities seems to agree with these estimating annual losses between £483 Million to £783 Million. They’re making this loss to break into the US market against competitors like Amazon. A strategy referred to as penetration pricing, but this is unsustainable and requires Temu to pressurise suppliers to cut prices to the point they can barely make profit.

Temu can accept such annual losses due to their parent company, PDD holdings, also owner of Pinduoduo which is China’s version of Temu and is very successful. The parent company is sitting on the largest net cash position of any public company not paying dividends, of $38 Billion and therefore is using Temu as an investment. This strategy to attempt to undercut market prices is aggressive and is unknown whether it will work against giants such as Amazon, however it is clear Temu has the money to back this investment.

Temu is very unsustainable, as they are far from breaking even, prices will have to evidently rise in the future, and Temu has not built brand reputation or loyalty. Customers only use Temu for their great value for money, and so I believe Temu will struggle to maintain high market share and will in the long run fizzle out.

What is Temu’s impact on economies?

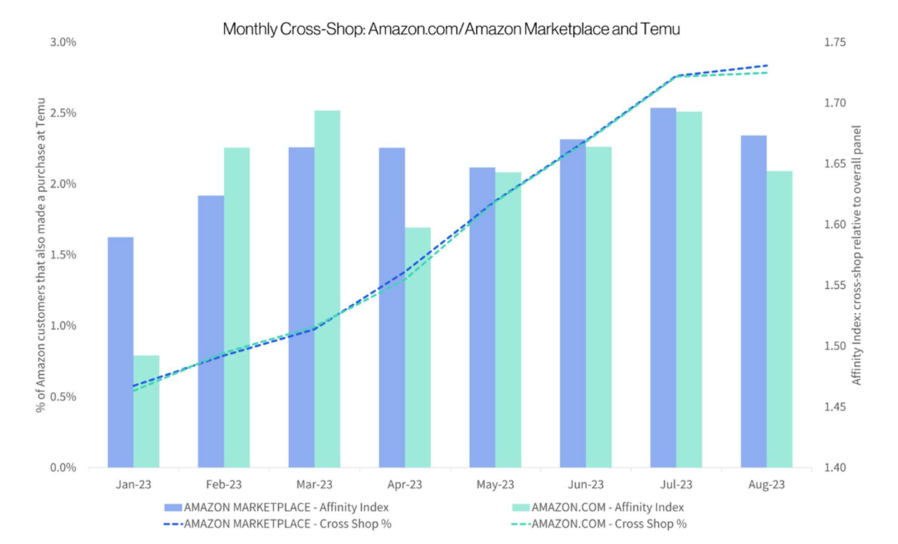

An increasing number of customers are now shopping on both Temu and Amazon, rising to 5% of customers using both shown below. This presents the issue faced by Amazon, where their customers are buying from Temu instead, while there is only a small percentage now, only slightly effecting Amazons sales and share price, soon they may need to address this ever-increasing competion.

This graph shows the increase over 2023 of cross shoppers at Amazon and Temu. The positive correlation presents a problem for Amazon, who’s customers are opening for the lower price alternative. Although Americans prefer to get goods from locally sourced businesses, they still purchase from sites like

Temu, showing the low prices are irresistible for consumers and local producers may have to move to niche, high quality goods to gain demand over the low price, mass producer competitor.

Long term, leading economists believe with Temu’s unsustainable business model they will struggle to reach market domination like Shein, as they lack accomplishments and profit for Temu is non-existent. But short term, they are continuously growing, and demand is not expected to fall soon.

Shein, the clothing centred version of Temu, now dominates in the retail industry and have resulted in lower demand and changing strategies for their competitors so we could expect a similar result for marketplaces like Temu.

What we should be careful of

Bargain prices may be coming at another cost, where Temu doesn’t make the goods themselves, instead acting as an online marketplace, factories may be exploiting forced or child labour. Evidence shows products produced in the banned region of Xinjiang linked to forced labour are still being sold on Temu making it clear Temu are careless to US regulations or need to keep a closer eye on their supply chains.

The last comment I wish to make is the controversy associated with the data Temu gains from signing up to their app. Although most of this is speculation, while losing so much money on each sale, the question is raised whether Temu is making this profit missing by selling our data. Cyber security professionals believe that it is not worth risking the potential invasion of privacy, along with Temu having ‘deep roots with the Chinese Communist Party’. Although there is a lack of hard evidence, I personally would steer clear of such applications as the potential data leakages and identity theft.

Temu’s significant financial backing positions it well to gain market share, but the question remains: how much is PDD holdings willing to invest?