On August 8, 2024, the Bank of Japan released the Summary of Opinions report from its recent Monetary Policy Meeting, in which the non-member board voted for an increase in the short term interest rates to 0.25%. This document gives use a good understanding of some key debates and discussions on perspectives for the central bank’s policymakers and future trajectory for Japan’s monetary policy. In the article, I will be listing some of the most important discussion points of the meeting that took place on the July 30 and 31.

1. Maintaining an Accommodative Monetary Policy

The BoJ’s appears to still remain loyal to its commitment to their ultra-loose monetary policy. All board members also agreed that the Japanese economic recovery still is fragile, and that the accommodative stance (meaning that the central bank is prepared to expand the money supply to boost economic growth) should continue to support it. However, despite a slightly increasing domestic demand, the board did express caution, by noting that some geopolitical and economic uncertainties could have an impact on the Japanese economy. These notably include the slower growth of a key trading partner, China.

Discussions also highlighted that although Japan’s economic recovery is ongoing, it remains uneven in some sectors, with certain industries recovering faster than others. The board also noted that a precipitated tightening of monetary policy could hinder the recovery, especially with an inflation (although rising) that fails to consistently reach the 2% target set by Bank of Japan.

2. Perspectives on Inflation

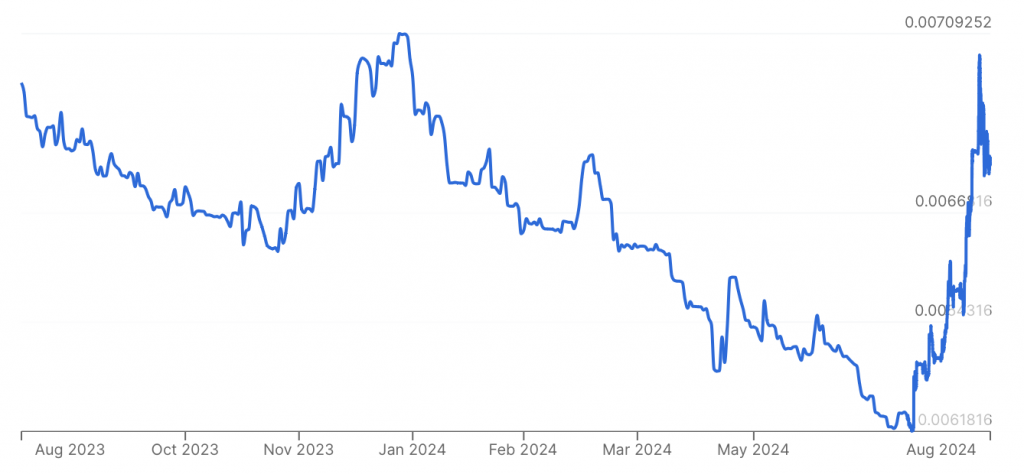

This brings us to another key discussion subject, inflation dynamics. The board has observed that both the weak yen, that reached yearly lows on July 10 (as seen on Figure 1), and the global rise in commodity prices contributed to the gradual build of inflationary pressure. As expected, the depreciation of the yen lead to higher import costs, which contributed to an overall increase in price levels. However, it is important to note that policymakers did not jump to conclusions regarding the duration of this inflationary trend, nothing to indicate if it is more temporary than permanent.

Figure 1: JPY to USD Chart:

However, concerns did emerge with regards to the sustainability of this recently found inflation in the long term. The major problem with this inflation however is that it is mainly attributed to ‘cost-push’ factors, which means it is driven by an increase in the cost of inputs, rather than by consumer demand. This is important and has to be notes, as when inflation is not demand-driven, it can have adverse effects on household spending and economic growth, in particular if wages do not rise as much as prices.

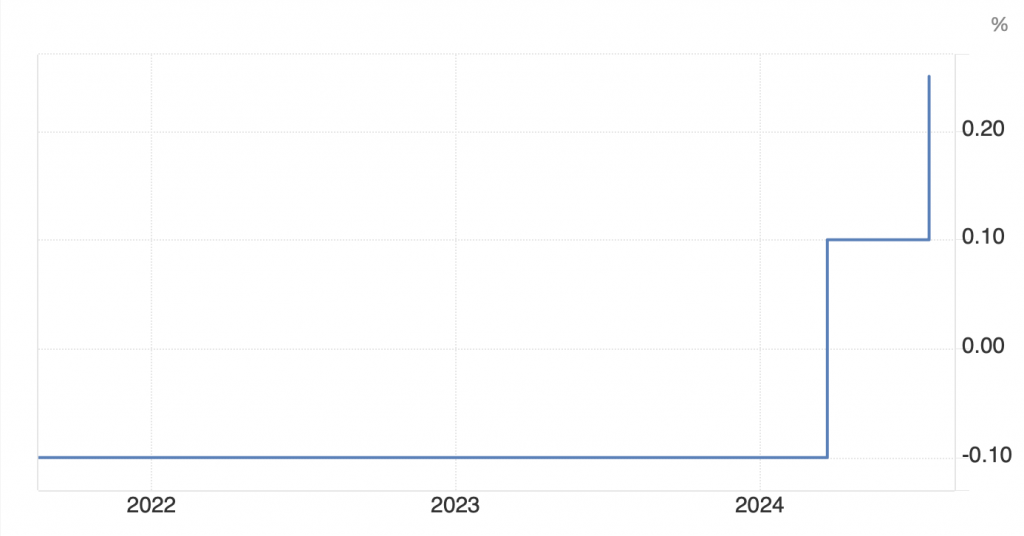

In addition to this, some policymakers seemed bothered by potential long-term effects a prolonged monetary easing could have on Japan’s financial system. As while the current policy seems to be a necessity to support the economy, carrying low interest rates for an extended period of time can cause financial imbalances. The risk is that low borrowing cost can encourage risk-seeking behaviours in financial markets that could then destabilise the financial system in the future. This is therefore one of the reasons that prompted the surprise rise of interest rates to a 15 years all time high to 0.25%.

3. Economic Growth Outlook

With the rise in domestic demand and the improving conditions globally, board members recognised that the Japanese economic outlook looked positive, and that the path to economic recovery promising. However caution is called for, as they also acknowledged some risks that could alter this recovery, such as the ongoing supply chain disruptions and the global slowdown in economic growth, particularly in China.

On top of discussing immediate economic concerns, the board members also discussed the need for structural reforms, with the ultimate goal of enhancing Japan’s long-term growth potential. It is clear that with the aging workforce and shrinking workforce that Japan can not only rely on monetary policy to drive economic growth. Instead, sustainable growth must pass by large scale investments in critical areas such as technology, education, and workforce development.

4. Concerns About the Yen’s Depreciation

Another significant topic was he depreciation the yen. Having a weak currency can come with its benefits, most notably in the Japanese export sector, by making goods more competitive abroad. Similarly, it also increases the cost of import for Japanese companies, which in itself creates inflation, something Japan has struggled to create ever since the asset bubble burst of 1989. However, a weak currency does come with negative impacts, and board members of the BoJ where quick to highlight that if this depreciation of the yen continued, businesses and households would have to bare the increase in prices for energy and food. Although the BoJ does not directly target the Japanese exchange rate, board members all agreed that it is important to monitor the impact inflation could have on the economic stability of the country. Therefore, by suddenly increasing the interest rate (as shown on Figure 2), Japan started attracting more foreign investment, which inevitably increased the demand and value of the yen.

Figure 2: Japan short-term interest rate:

5. Future Policy Adjustments

Bank of Japan also emphasised the need for more flexibility in its monetary policy. While for the moment the BoJ’s primary mission is to support the Japanese economic recovery, some board members did suggest that should inflation approach the 2% target in a sustainable way, the BoJ might have to adjust its policy framework. However, these changes would come in effect only after a well established recovery.

Conclusion

This Summary of Opinions from the BoJ’s August Monetary Policy Meeting highlights the cautious approach that has been adopted by central bankers while navigating the challenges faced by the Japanese economy. However, another interesting aspect of this document is that inflation overshoot is now a concern among board members. One board member even called for the BoJ to keep raising rates in a “timely and gradual manner”, as the neutral rate seems to be at least around 1%. We could therefore imagine that the hawkish stance of the BoJ is here to stay, a real turning point for a country that has been struggling with low inflation and even disinflation for multiple years.