Abstract

This research paper explores the influence of sustainable business practices on long-term profitability and brand image among major corporations. Drawing on a range of scholarly and industry sources, the study examines how sustainability—through environmental, social, and governance (ESG) efforts—impacts operational efficiency, consumer behavior, and stakeholder trust. Key findings suggest that sustainable practices can significantly reduce costs, improve risk management, and enhance corporate reputation. Furthermore, companies that invest in ESG initiatives often enjoy stronger relationships with customers, employees, and investors, resulting in improved brand loyalty and financial returns. While challenges such as greenwashing and implementation costs exist, the evidence overwhelmingly supports sustainability as a strategic advantage. The paper concludes that integrating sustainability into core business models not only fulfills ethical responsibilities but also drives competitive, long-term growth.

Introduction

As concerns about climate change, pollution, and ethical business practices grow, companies are increasingly turning to sustainability—not just as a trend, but as a strategy. Sustainable business practices focus on reducing environmental harm, using resources efficiently, and operating ethically. But do these practices actually help companies succeed financially and enhance their public image? The answer is yes. Sustainable business practices significantly enhance long-term profitability and strengthen brand image for major corporations by reducing operational costs, attracting environmentally conscious consumers, and building long-term stakeholder trust.

Reducing Operational Costs

One of the biggest benefits of sustainability is lower operational costs. Companies that cut energy use, reduce waste, and streamline their supply chains save money. A study of nearly 800 companies in China found that strong ESG (Environmental, Social, and Governance) practices led to higher profits, particularly through more efficient resource use and better governance (Chen et al.). Another source explains that businesses can reduce long-term costs by adopting energy-efficient technologies and minimizing their environmental impact (Ganti). These strategies help businesses become more financially stable while also being environmentally responsible.

Many companies also find that sustainability lowers long-term risk. By preparing for future environmental regulations, they avoid legal trouble and reduce the chance of costly fines. In addition, sustainable supply chains can protect companies from resource shortages or price spikes. For example, by reducing reliance on fossil fuels and choosing renewable energy, companies can stabilize costs and protect themselves against oil price volatility. Furthermore, waste reduction practices such as reusing materials and optimizing logistics have been shown to significantly reduce transportation and production costs, contributing to a leaner, more efficient operation.

These operational improvements often lead to innovations in product design and logistics. Companies like Unilever have redesigned packaging to use less material and increase recyclability, lowering production costs while reinforcing their green branding. Similarly, Walmart’s Project Gigaton initiative targets reducing greenhouse gas emissions by one billion metric tons by 2030, largely through supply chain optimization, which also improves operational margins. These examples demonstrate that sustainability and innovation frequently go hand-in-hand.

Moreover, governments in many countries are offering financial incentives for sustainable practices, such as tax credits for renewable energy investments and grants for energy-efficient upgrades. These incentives further reduce the financial burden of adopting sustainability, making the business case even stronger.

Attracting Environmentally Conscious Consumers

Sustainability also improves a company’s image and helps it attract more customers, especially younger ones. Consumers today, especially Millennials and Gen Z, prefer to buy from companies that care about the environment and social issues. According to SAGE Open, sustainable companies often gain customer loyalty, which boosts both short-term sales and long-term brand strength (Ting et al.). Companies that follow the “Triple Bottom Line” approach—focusing on people, planet, and profit—also stand out from competitors and build stronger relationships with customers (Kenton). In short, going green helps companies appeal to modern consumers who want to support businesses that align with their values.

This consumer support also leads to increased brand equity, which allows companies to charge higher prices without losing demand. Brands like Patagonia and Tesla are examples of companies that have successfully leveraged sustainability to attract a loyal fan base and justify premium pricing. Customers are not just buying a product—they’re supporting a mission. Moreover, companies that publicly commit to sustainability often enjoy positive media attention, which can further amplify brand reputation and lead to viral marketing opportunities on social media platforms.

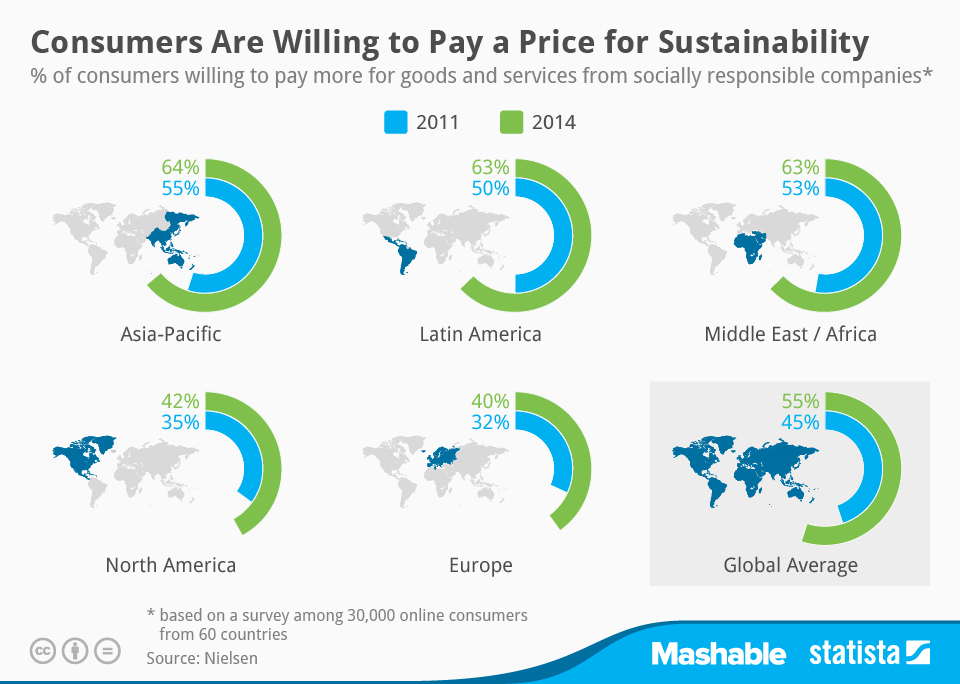

Research has shown that over 60% of consumers are willing to pay more for sustainable products (Nielsen). Companies that ignore this trend risk becoming irrelevant to a growing market of conscious consumers. By integrating sustainability into their core messaging, companies build emotional connections with customers, which can be more powerful than traditional product features.

Fig 1: Percentage of global consumers willing to pay more for products and services from companies committed to positive social and environmental impact.

Source: https://www.statista.com/chart/2401/willingness-to-pay-for-sustainable-products/

Additionally, companies that promote sustainability often gain access to new markets. For instance, consumers in Europe are particularly attentive to eco-labels and carbon footprints. Brands that demonstrate sustainable sourcing and ethical labor practices can more easily enter and succeed in international markets with strict environmental standards. This global appeal can be a major growth driver.

Building Long-Term Stakeholder Trust

Sustainability isn’t just about impressing customers—it also matters to investors, employees, and communities. Studies show that companies with strong ESG policies attract more investment and perform better financially over time (Zhao et al.). Investors now care about environmental responsibility when choosing where to put their money. Sustainable companies also tend to attract more innovative and loyal employees, as people want to work for organizations that make a positive impact (Chen et al.). Transparency in carbon reporting and sustainable operations further builds trust with the public and stakeholders (Amadeo).

Communities are also more likely to support businesses that give back and operate responsibly. This can lead to better local partnerships, smoother regulatory approval, and positive media coverage. In this way, sustainability becomes a tool not only for managing reputation but also for strengthening relationships across all levels of engagement. Additionally, as more companies adopt ESG frameworks and sustainability reporting standards such as the Global Reporting Initiative (GRI) or Task Force on Climate-related Financial Disclosures (TCFD), there is increasing pressure on lagging firms to improve transparency and performance. These frameworks allow stakeholders to compare performance metrics and hold businesses accountable.

Internal company culture also improves with sustainable values. Employees who feel that their company prioritizes ethics and the environment report higher job satisfaction and engagement. This translates into lower turnover rates and better productivity. Companies like Sales force and Google, known for their their strong environmental programs, consistently rank high on best-places-to-work lists, reflecting the positive impact of sustainability on internal morale.

Moreover, long-term stakeholder trust also helps build organizational resilience during crises. Companies with high ESG scores recovered more quickly from the economic shock of the COVID-19 pandemic. Their commitment to ethical practices, employee care, and environmental risk mitigation helped preserve brand loyalty and investor confidence, showcasing the durability of ESG-driven firms.

Challenges and Risks

Despite the benefits, there are challenges. Some companies struggle with the initial cost of adopting green technologies or changing their supply chains. Others may be tempted to exaggerate their sustainability efforts—a practice known as “greenwashing.” When companies are caught making false environmental claims, it can damage their reputation and trust with the public (Boyte-White). On the other hand, failing to address environmental damage can be even more costly. A study showed that U.S. companies lose about 18.5 cents of every profit dollar due to environmental damage (O’Connell). These findings suggest that in the long run, real sustainability is both more ethical and more profitable.

Another challenge is measuring and communicating impact. Companies need reliable ways to track progress and demonstrate real results. This has led to the rise of ESG ratings and carbon accounting tools, which help standardize sustainability performance across industries (Amadeo). While transparency is key, it also exposes companies to more scrutiny—so authenticity and follow-through are essential. Inconsistent definitions and lack of regulatory oversight in ESG rating systems can also cause confusion. Companies must navigate this complexity to avoid accusations of hypocrisy and gain real credibility.

Moreover, the pace of change required to meet global climate targets is daunting. Transitioning from legacy systems and retraining employees requires time, capital, and strong leadership. Companies must balance short-term financial performance with long-term sustainability goals, often amid shareholder pressure for immediate returns. This balancing act can strain leadership and demands careful strategic planning.

Additionally, small and medium-sized enterprises (SMEs) often face steeper barriers in implementing sustainability initiatives. Unlike large corporations, they may lack access to capital, technical expertise, or economies of scale needed for green innovation. Policymakers and large firms can help by offering support systems, partnerships, and incentives that enable SMEs to participate in sustainable value chains.

Conclusion

Sustainable business practices are no longer optional for companies that want to succeed in the long run. They lower operational costs, attract loyal and values-driven customers, and build trust with investors, employees, and communities. While challenges like greenwashing and up front costs exist, the overall evidence shows that sustainability boosts both profitability and brand image. In a world where environmental and social responsibility matter more than ever, going green is not just good ethics—it’s smart business. By committing to sustainability, companies prepare for the future, meet evolving consumer expectations, and contribute positively to society. As sustainability becomes a core business value rather than a marketing add-on, the companies that lead with purpose will be the ones that thrive. Detailed ESG reporting, stakeholder engagement, and innovation in sustainable technologies will separate leaders from laggards, and those who embrace change today will gain the competitive edge tomorrow. In an era shaped by climate realities and social accountability, aligning business success with planetary well-being is not only possible—it is essential.

Works Cited

Amadeo, Kimberly. “Carbon Accounting: What It Is, Why It Matters.” Investopedia, 4 May 2024, https://www.investopedia.com/carbon-accounting-7562229.

Boyte-White, Claire. “What Is a Company’s ESG Score?” Investopedia, 21 Feb. 2023, https://www.investopedia.com/company-esg-score-7480372.

Chen, Wenjie, et al. “ESG Performance and Financial Return: Evidence from China’s A-Share Market.” Frontiers in Sustainability, vol. 5, 2024, https://www.frontiersin.org/journals/sustainability/articles/10.3389/frsus.2024.1454822/full.

Chen, Xiang, et al. “ESG Performance and Firm Value: Evidence from China’s ListedCompanies.” Frontiers in Environmental Science, vol. 13, 2025,https://www.frontiersin.org/journals/environmental-science/articles/10.3389/fenvs.2025.1507151 /full.

Ganti, Akhilesh. “The Three Pillars of Corporate Sustainability.” Investopedia, 5 Oct. 2015, https://www.investopedia.com/articles/investing/100515/three-pillars-corporate-sustainability.asp

Kenton, Will. “Triple Bottom Line (TBL): What It Is and Why It Matters.” Investopedia, 24 Jan. 2023, https://www.investopedia.com/terms/t/triple-bottom-line.asp.

O’Connell, Brian. “U.S. Companies’ Greenhouse Gas Damage: 18.5 Cents Per Dollar of Profit.” Investopedia, 30 Apr. 2024, https://www.investopedia.com/us-companies-greenhouse-gas-damage-study-7853027.

Ting, Mei, et al. “Does ESG Investment Lead to Sustainable Financial Performance?” SAGEOpen, vol. 11, no. 3, 2021, https://journals.sagepub.com/doi/full/10.1177/21582440211021598.

Zhao, Yujie, et al. “ESG Performance and Innovation in the Energy Industry.” Sustainability, vol. 16, no. 12, 2024, https://www.mdpi.com/2071-1050/16/12/5042.

“The Sustainability Imperative: New Insights on Consumer Expectations.” Nielsen, Oct. 2015, https://nielseniq.com/global/en/insights/analysis/2015/the-sustainability-imperative-2/.