Public Approval or Economic Prosperity? How Kamala Harris’ Corporate Tax Hike Could Backfire on the Economy

There is no denying that the Democrats have played all their cards right since President Joe Biden decided to step down from the upcoming US elections. An incredibly positive campaign for the current Vice President supported by an impressive running mate, Tim Walz, has put the heat back on Donald Trump’s camp in recent months. However, Vice President Harris has not spoken much on her policies. Apart from her “no tax on tips” plan, which former President Trump also promises to implement, Kamala Harris has decided to stay loyal to “Bidenomics.” This has motivated Harris to take an unsurprising rival stance to her opponent Donald Trump regarding Corporate Tax rates.

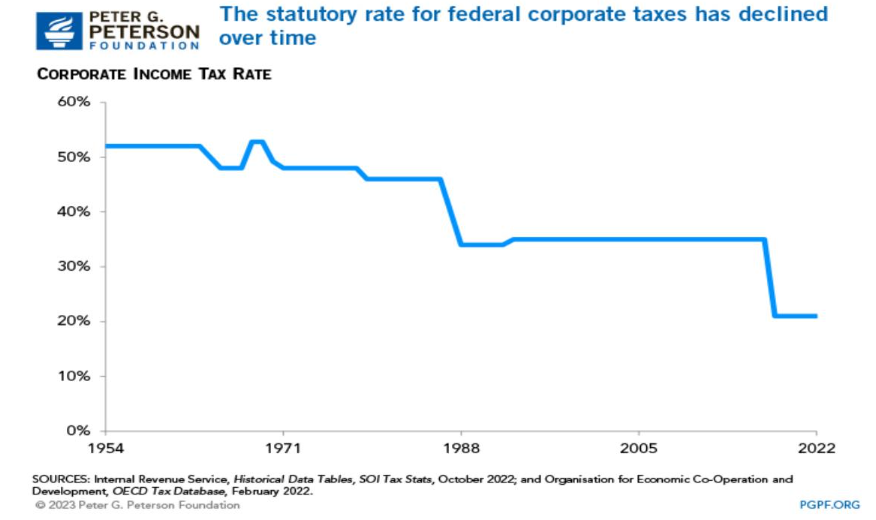

To some, this may not seem like that big a deal, but to Trump, this endangers his presidential legacy. Remember, the former President’s biggest domestic project was his 2017 Tax Law which saw Corporate Tax go from 35% to 21%, in an effort to bring offshoring companies back to the US, creating more jobs for the American people. This angered many Democrats, who labelled it as an attack on the lower classes and a ploy for Trump’s rich friends to get richer. No one knows the real reason behind it, it’s his word against theirs.

Nevertheless, should Kamala Harris go from Madam Vice President to Madam President just after the turn of the year, the White House will ensure that the Corporate Tax rate gets raised to 28%. This is a tactical opposition for Kamala Harris to take against Trump, socially speaking, as it can be seen as a rise against the rich and an empowering move for the working class. However, politics and sociology aren’t our only focus, so let’s dive into what this increase in Corporate Tax would do to the local markets and the general economy.

“Increasing government revenue and improving the budgetary position” – it’s what Harris intends, and hopes will happen should Corporate Tax increase, and, to her credit, it most likely will. But will that really help the economy? In the short run, yes, as it will indeed give the government more means to act. In the long run, it’s more complicated.

First off, the American budgetary position doesn’t necessarily need fixing. Over the course of the last century, the Americans have leveraged their status after WWII to successfully craft an international economic ecosystem where almost every country that partakes in trade, funds the American way of life. This means that, unless all these countries suddenly decide to stop partaking in such a system, the Americans can basically borrow, print money and indebt themselves continuously without fearing a sovereign debt crisis.

Now, regarding the economy, I could draw a few of graphs and leave it there, but if you’ve made it this far into the article, you most likely want a real explanation1. In the long run, as a response to the higher corporate tax, many firms could shut down their operations in the US, whether it be fully closing down, or switching back to the pre-Trump trend of offshoring. Hard working Americans could lose their jobs which translates to higher unemployment and less disposable incomes in society. This instigates less consumption on the domestic scale, i.e. lower aggregate demand, which incentivises firms as a whole to cut production in order to meet the new demand. As a result, more jobs are lost. It’s possible for this vicious cycle to continue until a new equilibrium is reached with a higher level of unemployment than the pre-policy implementation level.

In short, Harris’ higher Corporate Tax rate may appear as a good policy for a vast majority of the population, but certain economic repercussions could be harmful in the long run.