The new Labour government has made it one of its goals to scrap the “non-dom” status, a method frequently used by high-value individuals for tax avoidance purposes. In the days that followed the swearing-in of the newly elected government, the Financial Times published an article in which they claimed that the “UK is on track to lose 17% of its millionaires by 2028”, a trend that prompts an intriguing question: do we really need millionaires residing in the UK? Or are we better off without? Therefore, using our understanding of macroeconomics, let’s dive into the implications of having millionaires in the country- or lack thereof.

Millionaires significantly impact the economy of the country they live in – so far, so clear. Activities such as spending in local markets, investing in property, luxury goods and services stimulate the local economy. Let’s take the example of high-end real estate. The engaging in these transactions directly contributes to the market’s dynamism, which not only supports construction and related industries but also generates substantial tax revenues through stamp duties and other taxes. Indeed, the wealthy contribute a substantial portion of tax revenues (when they pay them), and in the UK, the top 1% of earners contribute nearly 30% of income taxes. This revenue supports essential public services such as healthcare, education, and infrastructure. So, when millionaires leave, it could create a noticeable gap in public funding and social welfare.

On top of this, millionaires in the UK invest in local businesses, either through direct ownership, or through the funding of startups and small enterprises. For instance, many tech start-ups in London attract angel investors and venture capitalists – often wealthy inhabitants. This type of scheme enables job creation and innovation, a foundational base in the broader economic ecosystem. This could explain why the cities with the most millionaires like London and a few cities in the South of England are generally wealthier, and better off.

To reiterate, there is an evident link between concentration of wealth and overall standard of living. Take Switzerland for example, it’s the country in Europe with the most millionaires, and, unsurprisingly, it also has the highest HDI.

Now, the question becomes: do millionaires need to reside in the UK to play the role of the “investors” in society?

The answer to that question is simultaneously yes and no.

On the one hand, millionaires don’t technically need to live in the city or even country in which they have made investments; we have globalisation to thank for that. Indeed, this day and age enables millionaires to make investments remotely. The free flow of assets and cash across national borders makes it so that the wealthy can invest all over the world, rendering it virtually unnecessary for them to live in the countries they choose to invest in.

On the other hand, beyond the strict financial aspect of the term “investor”, the presence of millionaires enhances the general image of the UK. In other words, the occupancy of millionaires in the UK enhances its status and social fabric. Economic pursuits followed by philanthropists in the arts and culture, for example, make up the luxurious reputations of cities like London that we all know about. After all, who doesn’t dream of waking up in the prestigious borough of Kensington and Chelsea, or spending the day frequenting the lively museums of the city centre?

Nonetheless, the social impact of wealthy residents is not without its challenges. The presence of wealthy individuals can drive up the cost of living in certain areas, particularly in major cities, leading to issues like gentrification. Take the housing market, for example. To simplify, the spending habits of millionaires can distort markets.

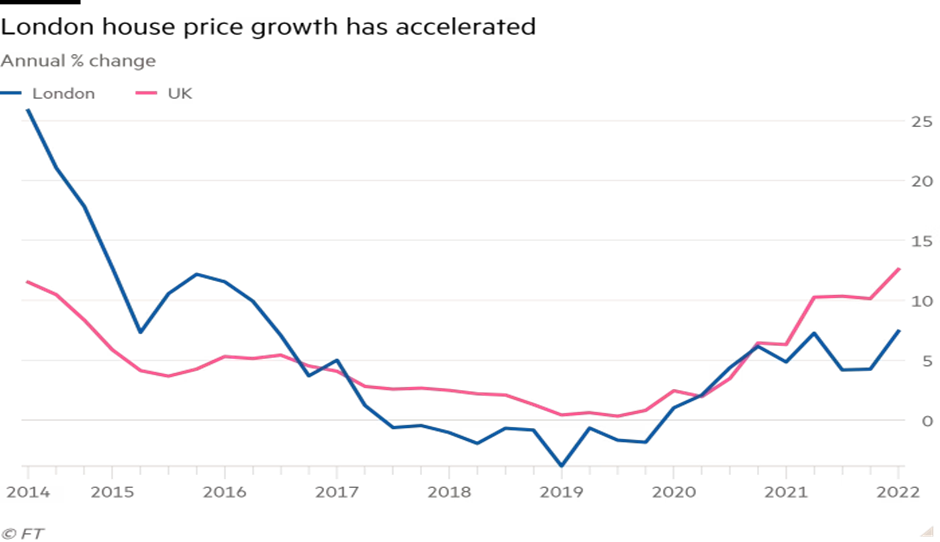

High-net-worth individuals often invest in high-end properties, driving up prices and making housing less affordable for the average person. In London, the prices of property and housing have skyrocketed – in part due to the large concentration of wealth and increased overall demand – which only furthers the gap of inequality. Let’s remember that while some are investing in luxury real estate, many struggle to afford basic housing. In fact, many wealthy individuals buy properties as investments, leaving these estates uninhabited until they decide to sell them for a profit. Numerous people cannot afford to buy even one flat or house to live in full-time, while others are buying their n-th property to leave empty- or lease for a price most cannot afford.

So, do we need millionaires in the UK?

As we have seen, the answer is not as straightforward as it would appear to be.

The rush of investments, spending, and philanthropic efforts can be valuable assets to the nation. Equally, the growing concerns regarding the economic and social repercussions cannot be ignored.

What I believe we should keep in mind from this argument is that the positives of having millionaires in the country do not always seem to outweigh the negatives. Have a think yourself – The Financial Times’ estimate: a blessing, or our demise?