Prime Minster Sir Keir Starmer has said that the October Budget will be ‘painful’ in his speech from 10 Downing Street, last Tuesday. He claimed that his government needed to solve the £22 billion black hole in the public finances from the previous government. The Chancellor, Rachel Reeves, is planning to withdraw the winter fuel payment from pensioners with it estimated to affect around 10 million pensioners that will lose the benefit of up to £300 from mid-September which will save the government £1.4 billion this financial year (Geiger & Watt, 2024).

However, this is still far from filling all the required spending gaps as tax rises will be included in the Autumn Budget as well. The Labour government will keep their promises of ruling out the increase in income tax, national insurance and VAT. Thus, Starmer urged “those with the broadest shoulders should bear the heavier burden”. Meaning the government will target the wealthy taxpayers as their main income.

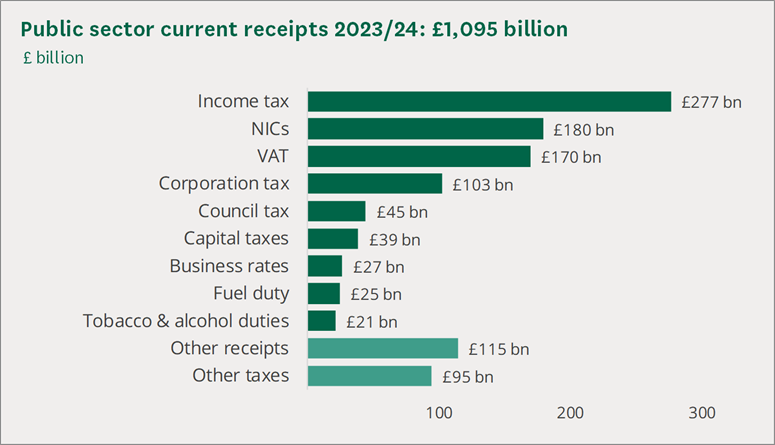

Capital gains tax is likely to be one of the options to raise government funds for the Labour government. As the highest tax rate of CGT is 28%, far lower than the 45% highest tax rate of income tax, this meant that whilst tax revenue from CGT was £39 billion, when compared to the combined tax revenue of income tax, national insurance and VAT, which brought in £627 billion during 2023/24, it falls far behind. However, I believe raising capital gains tax to the same level as income tax would be a mistake. Last year, Jeremy Hunt, the former Chancellor, announced an increase in the corporate income tax rate from 19% to 25%. Since investors receive their capital gains after it’s taxed by corporate tax, a large jump in capital gains tax may hurt investor’s confidence.

Tax Statistics Overview from the House of Common Library:

In addition, the government may increase inheritance tax. It only generated £7.5 billion in 2023/24 and as there is a larger bandwidth to raise it, things can be done such as restricting the tax relief allowance to raise revenues further.

These measures have caused concerned amongst economists, about whether imposing higher taxes on wealthy taxpayers will deteriorate the investment environment in the UK. Some wealth managers reported their clients were selling their assets when Labour came into office. Private equity executives also warn the rise of capital gains tax could make UK unattractive to investors (Agnew & Heal, n.d.).

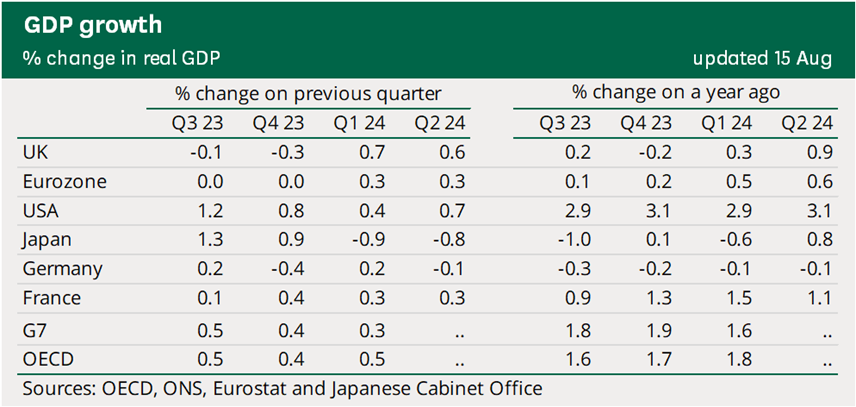

However, taxation is only one of the reasons why millionaires and financial institutions determine where they should invest. The UK still has a few advantages such as relatively stable politics and economy when compared to the European continent and the US. Although the UK economy suffered from recession due to COVID-19 and inflation, the UK was the fastest-growing economy in the G7 group in the first quarter and still achieved a higher growth rate compared to the Eurozone in the second quarter. The cut in interest rate from 5.25% to 5% by the Bank of England in August indicates that economists expect the inflation rate will fall back to the target rate. Borrowing and investment will benefit from low interest rates.

GDP – International Comparisons: Key Economic Indicators from the House of Common Library:

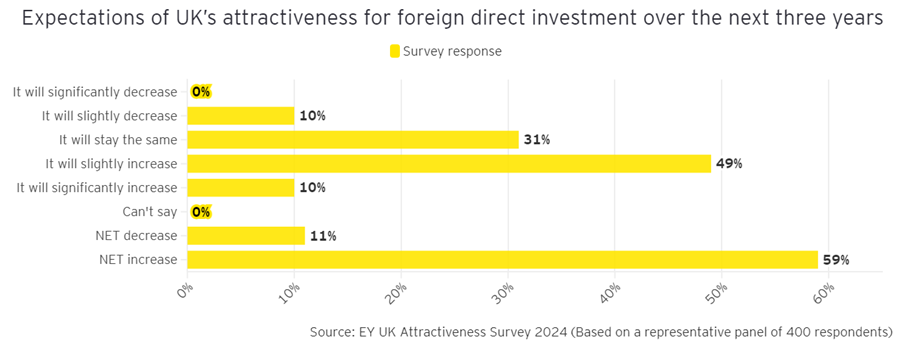

Hywel Ball, EY UK Chair, comments: “The UK achieved a strong performance for foreign direct investment last year, driven by a resurgence in tech investment and impressive annual growth in sectors such as business services. Significantly, this has also been strategically valuable investment, with UK foreign direct investment generating a greater number of jobs than elsewhere in Europe” (Joyce, 2024). According to the EY UK Attractiveness Survey 2024, more than half of the investors out of 400 international investment decision-makers are willing to invest in the UK.

Taxation will always bring drawbacks for some groups of people. It depends on which business and financial activities you are involved in. Capital gains tax is charged when you sell your assets. In reality, the rich usually reinvest their assets instead of selling them to avoid taxation and use their assets as collateral to leverage debt which is non-taxable. Long-term investments in stock are less likely to be affected but real estate, speculations and leverage buyouts may reduce as the turnover cost has been risen by higher tax.

Due to the drawbacks of taxation, some question whether there are other methods to raise funds. A professor of accounting at Sheffield University claimed “It is that the Bank of England could offer an overdraft to the government. It did this in March 2020 when the Covid crisis started. It said then that the government could have an overdraft of £20 billion… on something called the Ways and Means Account” (Murphy, 2024). Another method would be quantitative easing via the gilts in the financial markets.

Therefore, I think the reason of raising taxes on wealthy taxpayers may not just be for the “£22 billion blackhole”. The government may have a longer-term plan in redistributing wealth rather than filling the short-term payment for this financial year.

Increasing taxes can provide sufficient revenue for the operation of the government and welfare to low-income families. However, wealthy taxpayers and foreign investment are still critical to the economy. A good narrative is needed to convince investors the rise of taxation is justified to the economy as a whole. The rise of wealth in the low and middle classes will stimulate consumption which brings growth to sales in businesses. Reassuring the profitability of investing in the UK and spending the tax efficiently to bring growth to the economy will be the key tasks of the current government.

Yooo my favourite econ analyst dropped a new article!!!