Introduction:

Imagine a world where you can send money to anyone, anywhere, instantly and without the need for a bank. Welcome to the world of digital currencies! From Bitcoin to Ethereum, these digital assets are not just for tech enthusiasts anymore—they’re reshaping our financial and political landscapes. Let’s dive into the fascinating world of digital currencies and explore their impact on global economies and political systems.

The Rise of Digital Currencies

Bitcoin!

It all started in 2009 with the mysterious Satoshi Nakamoto, who introduced Bitcoin as a response to the 2008 financial crisis. Fast forward to today, and we have thousands of cryptocurrencies, each with its own unique twist. But what makes these digital currencies so special? It’s all about the blockchain—a decentralized ledger that ensures transparency and security. Think of it as a digital notebook that everyone can see but no one can alter.

Economic Implications

1.Financial Inclusion: Did you know that over 1.7 billion people worldwide don’t have access to traditional banking services? Digital currencies are changing that. In regions like Africa and Southeast Asia, mobile-based cryptocurrency wallets are becoming a lifeline, allowing people to store and transfer money without a bank account. It’s like having a bank in your pocket!

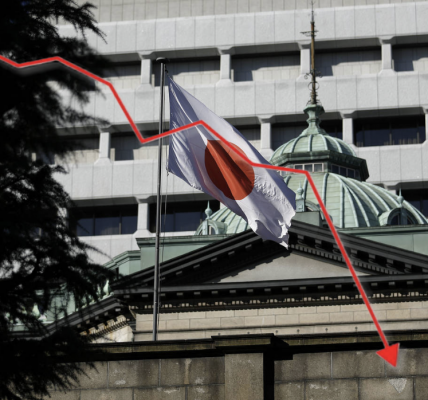

2.Volatility and Speculation: Cryptocurrencies are like a rollercoaster ride—exciting but not for the faint-hearted. Their prices can skyrocket or plummet in a matter of hours. This volatility has attracted speculators and investors looking for quick gains. But beware, it’s a wild ride that requires a strong stomach!

3.Regulation and Stability: Governments around the world are scratching their heads, trying to figure out how to regulate digital currencies. Some countries have embraced them, while others have imposed strict regulations or outright bans. It’s a delicate balance between fostering innovation and ensuring financial stability.

4.Impact on Traditional Banking: Traditional banks are feeling the heat. With the rise of digital currencies, banks are exploring ways to integrate blockchain technology into their operations. Some are even developing their own digital currencies, known as central bank digital currencies (CBDCs). It’s a race to stay relevant in a rapidly changing financial landscape.

5.Cross-Border Transactions: Sending money across borders has never been easier or cheaper. Digital currencies facilitate faster and cheaper cross-border transactions compared to traditional banking systems. This has significant implications for international trade and remittances. Imagine sending money to a friend halfway across the world in seconds!

Political Implications

1.Sovereignty and Control: Digital currencies are shaking up traditional notions of sovereignty and control over monetary policy. Governments are worried about losing control over their financial systems and the potential for cryptocurrencies to facilitate illegal activities. It’s a new frontier in the battle for financial control.

2.Geopolitical Tensions: The rise of digital currencies has added a new dimension to geopolitical tensions. Countries like China are developing their own digital currencies to reduce reliance on the US dollar and gain greater control over their economies. It’s a digital arms race with far-reaching implications.

3.Privacy and Surveillance: Cryptocurrencies offer a level of privacy that traditional financial systems do not. This has raised concerns about their use in illegal activities, prompting governments to consider measures to monitor and regulate transactions. It’s a tug-of-war between privacy and security.

4.Impact on Sanctions: Digital currencies can potentially undermine the effectiveness of economic sanctions. Countries facing sanctions, such as Iran and North Korea, have explored using cryptocurrencies to bypass restrictions and access global markets. This has led to calls for international cooperation to regulate digital currencies and prevent their misuse.

Case Studies

1.El Salvador: 🇸🇻 in 2021, El Salvador made headlines by becoming the first country to adopt Bitcoin as legal tender. This bold move has sparked debates about the benefits and risks of integrating cryptocurrencies into national economies. Will it be a game-changer or a risky gamble? Only time will tell.

2.China: 🇨🇳 China has taken a different approach by developing its own digital currency, the Digital Yuan. This state-controlled currency aims to enhance financial inclusion and reduce the country’s reliance on the US dollar. It’s also seen as a tool for the Chinese government to increase surveillance and control over financial transactions.

3.Venezuela: 🇻🇪 Faced with hyperinflation and economic collapse, Venezuela launched its own cryptocurrency, the Petro, in 2018. Backed by the country’s oil reserves, the Petro was intended to stabilize the economy and circumvent international sanctions. However, the project has faced significant challenges, including lack of trust and adoption both domestically and internationally.

4.United States: 🇺🇸 The US has taken a cautious approach to digital currencies, focusing on regulatory oversight and consumer protection. The Federal Reserve is exploring the possibility of issuing a digital dollar, while the Securities and Exchange Commission (SEC) has been actively regulating cryptocurrency markets to prevent fraud and protect investors.

Future Prospects

The future of digital currencies is uncertain but promising. As technology advances and regulatory frameworks evolve, digital currencies could become a more integral part of the global financial system. However, challenges such as volatility, regulatory uncertainty, and geopolitical tensions must be addressed.

1.Technological Advancements: Innovations in blockchain technology, such as scalability solutions and interoperability between different blockchain networks, will play a crucial role in the future of digital currencies. Projects like Ethereum 2.0 aim to address scalability issues and improve the efficiency of blockchain networks.

2.Regulatory Developments: The development of clear and consistent regulatory frameworks will be essential for the growth and stability of digital currencies. International cooperation and coordination will be necessary to address the cross-border nature of cryptocurrencies and prevent regulatory arbitrage.

3.Adoption by Financial Institutions: As traditional financial institutions continue to explore and adopt blockchain technology, the integration of digital currencies into mainstream finance is likely to increase. This could lead to the development of new financial products and services, such as decentralized finance (DeFi) platforms that offer lending, borrowing, and trading without intermediaries.

4.Central Bank Digital Currencies (CBDCs): The development and implementation of CBDCs by central banks around the world will have significant implications for the future of digital currencies. CBDCs could provide a state-backed alternative to cryptocurrencies, offering the benefits of digital currencies while maintaining government control over monetary policy.

5.Public Perception and Trust: The success of digital currencies will depend on public perception and trust. Efforts to educate the public about the benefits and risks of digital currencies, as well as measures to ensure security and protect consumers, will be crucial for widespread adoption.

Statistics Table :

| Country | Cryptocurrency Adoption (%) | Regulatory Status |

| El Salvador | 70 | Legal Tender |

| China | 40 | State-Controlled Digital Yuan |

| Venezuela | 50 | Petro (State Cryptocurrency) |

| United States | 30 | Regulatory Oversight |

| Nigeria | 60 | Crypto-Friendly |

Conclusion

Digital currencies are reshaping the financial and political landscape in profound ways. Their impact on global economies and political systems is complex and multifaceted, offering both opportunities and challenges. As we move forward, it will be crucial for policymakers, financial institutions, and individuals to navigate this evolving landscape with caution and foresight.

The rise of digital currencies represents a paradigm shift in the way we think about money and financial systems. While the future remains uncertain, one thing is clear: digital currencies are here to stay, and their influence will continue to grow in the years to come.

References

- Bank for International Settlements. (2021). Central bank digital currencies: foundational principles and core features. Retrieved from https://www.bis.org

- Baur, D. G., Hong, K., & Lee, A. D. (2018). Bitcoin: Medium of exchange or speculative assets? Journal of International Financial Markets, Institutions and Money, 54, 177-189.

- BBC News. (2021). El Salvador makes Bitcoin legal tender. Retrieved from https://www.bbc.com

- Buterin, V. (2020). Ethereum 2.0: The next evolution of the Ethereum blockchain. Retrieved from https://ethereum.org

- DeFi Pulse. (2021). The DeFi ecosystem. Retrieved from https://defipulse.com

- European Commission. (2020). Markets in Crypto-Assets (MiCA) regulation. Retrieved from https://ec.europa.eu

- FATF. (2019). Guidance for a risk-based approach to virtual assets and virtual asset service providers. Retrieved from https://www.fatf-gafi.org

- Federal Reserve. (2021). Central bank digital currency: A framework for assessing the benefits and risks. Retrieved from https://www.federalreserve.gov

- IMF. (2021). Digital money across borders: Macro-financial implications. Retrieved from https://www.imf.org

- Narayanan, A., Bonneau, J., Felten, E., Miller, A., & Goldfeder, S. (2016). Bitcoin and cryptocurrency technologies: A comprehensive introduction. Princeton University Press.

- People’s Bank of China. (2020). Progress of research & development of E-CNY in China. Retrieved from https://www.pbc.gov.cn

- Ripple. (2020). RippleNet: Faster, cheaper .

I am extremely impressed with your writing skills as well as

with the layout on your blog. Is this a paid theme or did you modify it yourself?

Either way keep up the excellent quality writing, it’s rare to see a great blog like this one

today.

I do not even know how I ended up here, but I thought this post was great.

I don’t know who you are but definitely you’re

going to a famous blogger if you aren’t already 😉 Cheers!

Fabulous, what a weblog it is! This website presents useful data to us, keep

it up.

I am regular reader, how are you everybody?

This paragraph posted at this site is really fastidious.