BP’s “Fundamental Reset”: A Sign of the Energy Sector’s Broader Retreat from Renewables

BP has announced what it calls a “strategy fundamentally reset”, a dramatic shift that sees

the oil giant drop its green targets and refocus on oil and gas. This marks the first major

policy move under CEO Murray Auchincloss, undoing the work of his predecessor, Bernard

Looney, who had pledged to cut oil and gas output by 40% and significantly expand BP’s

renewable energy capacity.

As part of this shift, BP has abandoned its target to increase renewable energy capacity to

50 gigawatts (the equivalent amount of energy produced by 50 nuclear plants), a stark

reversal given that its current renewable capacity stands at just 8.3GW. The company

frames this reset as a move to drive improved performance, increase free cash flow, and

enhance long-term shareholder value.

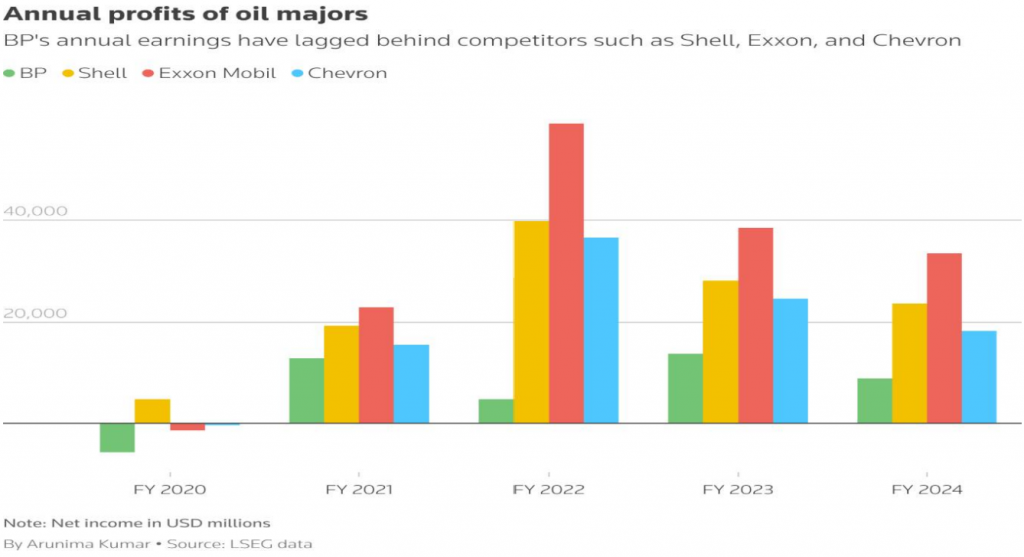

This change of this magnitudes has been coming for some time considering BP’s poor recent

performances. An example is BP’s struggles with offshore wind. In the U.S., BP invested

heavily in offshore wind projects alongside Equinor, aiming to develop wind farms off the

coasts of New York and Massachusetts. However, rising costs due to inflation, supply chain

disruptions, and higher interest rates severely impacted profitability, leading BP to write

down $540 million on its offshore wind business in 2023. More broadly, BP’s renewable

energy projects have delivered returns of only 6-8%, far below the 15-20% returns typically

generated from oil and gas. This stark contrast made it difficult for BP to justify further

investments in renewables, especially as high oil prices kept fossil fuel profits strong causing

the British oil giant to lack behind it’s competitors.

But the real driving force behind this policy U-turn is pressure from investors, particularly

activist hedge fund Elliott Management, known for its aggressive interventions in corporate

strategy. Elliott, which has wielded its influence over firms such as Honeywell and Southwest

Airlines, has pushed for tighter cost management at BP, reflecting a broader investor

backlash against the financial performance of energy companies that have pivoted toward

renewables. Ultimately, this pressure has played a critical role in steering BP back toward its

fossil fuel roots.

A Sector-Wide Retreat

BP is far from alone in this reversal. Across the energy sector, major companies are quietly

stepping back from renewables in favor of oil and gas. Shell, for instance, has scaled back

investment in new offshore wind projects and weakened its carbon reduction targets.

Similarly, Norwegian state-controlled Equinor, despite acquiring a majority stake in wind

power group Ørsted, recently announced that it would slow down renewable investments

until at least 2030.

The motivation behind this shift is clear: in the mind of investors, renewables have simply

not delivered the financial returns that fossil fuels continue to generate. While European

energy giants pivoted toward renewables in recent years, their US counterparts such as

Chevron and ExxonMobil have doubled down on oil and gas— and have significantly

outperformed them financially.

“Geopolitical disruptions like the invasion of Ukraine have weakened CEO incentives to

prioritise the low-carbon transition amid high oil prices and evolving investor expectations,”

explains Rohan Bowater, an analyst at Accela Research. In essence, the war, market

volatility, and persistent demand for fossil fuels have made the energy transition a much

harder sell to investors.

The Road Ahead

BP’s move is not just a course correction; it is a major leap forward on a growing industry

trend. With the newly elected Trump administration signaling strong support for oil and gas

investment, the policy behind the infamous “drill baby drill”, while maintaining skepticism

toward renewables, it is likely that this sector-wide shift will continue and endure. If energy

companies were already cooling on renewables, a pro-fossil fuel US government will only

reinforce this trajectory.

BP’s fundamental reset is therefore not an isolated move—it is a clear indication of the

industry’s broader retreat from ambitious green commitments. As long as fossil fuels remain

more lucrative and geopolitics continues to drive high oil prices, Big Oil’s renewable

ambitions will take a backseat to profits.

Fascinating!

Super useful and interesting article. Thank you for

sharing such great work!